Housing Crisis – Is this 2008 all over again?

8.00 am in Grand Central today; Monday, March 16th. You would be forgiven for thinking it was Christmas Day….except, of course, Christmas Day is quite busy at Grand Central.

It seems the entire of NYC is working from home as we finally start to take the virus seriously. I’m sorry to admit that I was one of those who thought it was much ado about nothing. I could not have been more wrong. I hope we are facing a “short-sharp-shock”, I am worried that we are facing something more serious. Overnight, the fed cut rates from 1.0% to zero and has announced a $700 million liquidity program which will see it buying Treasuries and mortgage assets in an effort to reassure investors.

As I write, investors seem anything but reassured. Key stock indexes are down about -8%, Bonds (TLT) are up 5% and the panic continues.

Our inbox is filling with questions from investors asking:

Is my investment safe, is this 2008 all-over-again?

Is this a good time to refinance my own mortgage?

Are you still planning on paying 8%….does this mean you will reduce your target payout?

The good news is that we are 92% in cash as we prepare for some large purchases in the coming months. I think those purchases could now become larger and the pricing will likely be lower as sellers seek sources of liquidity and quality counterparties.

As to where rates go from here, it is my view that low rates are here for quite some time (maybe years)…though they may not find their way to the mortgage market for several months.

Why? The global economy is coming to a shuddering halt. The 2008 financial crisis saw consumption fall off a cliff. The economists call this a demand-side shock caused by job and income loss…dampening demand. This time we have a demand and a supply-side shock: my colleagues shopping in NY and NJ this weekend found supermarkets with empty shelves, even Amazon is out-of-stock on many key items. American Airlines announced it will reduce capacity by 30% and that may last through the peak summer season. Others are following suit.

Business hotels around our offices in downtown Manhattan are offering 50% – 70% reductions to fill rooms….yet it seems they remain empty.

A stalled Economy

Restarting a stalled economy is very difficult. It’s a chicken-and-egg situation. Demand is slow to re-ignite because people hoard cash just in case things get worse. Supply is slow to re-ignite because vendors are worried there will be no demand. Remember, 88% of US companies employ fewer than 20 people. The lay-offs have already started in hospitality, transport and retail. The longer the current shock persists, the more difficult it will be for our favorite coffee-shops, restaurants and other small businesses to re-open.

Mortgage Delinquencies

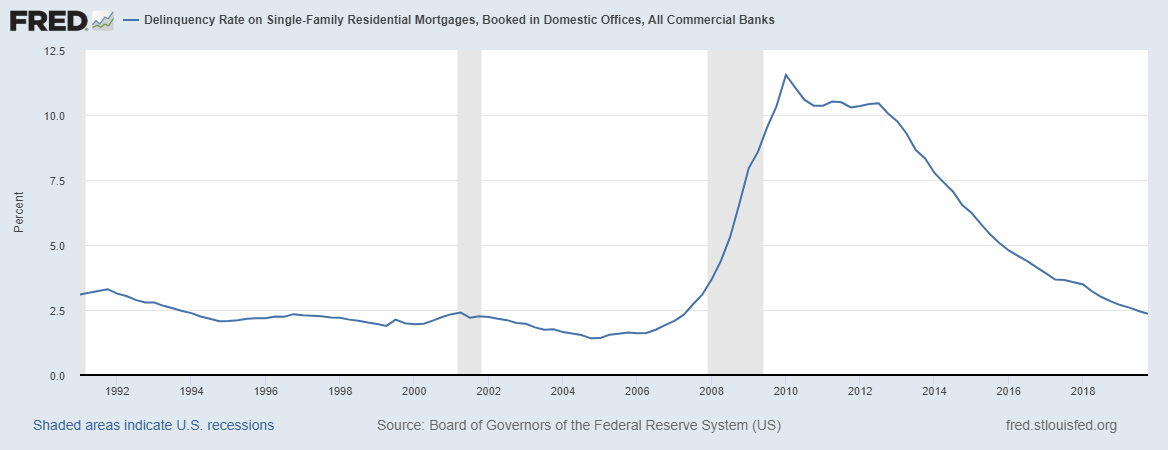

It will be difficult for many households to keep up with all their payments. The median American household has just $11,700 in savings. Some homeowners will quickly fall behind on mortgage payments as they prioritize other expenditures (food, healthcare, gas, phone and auto payments). We fully expect a wave of mortgage delinquencies (and hopefully a federal program to help deal with them). In 2011, we saw delinquencies spike from the 30-year average of ~3% to a peak of 11%.

Outlook

The key drivers for the next 90 days will be:

Facts: Do we see any evidence of sustained containment? All eyes are on China to provide some clue to what might happen next. The graph from John Hopkins below shows total cases in China in orange and total recoveries in green. The yellow line shows new cases outside of China. It looks like we are 2+ months behind China and given the slope of the curve, it’s probably going to get a lot worse before it gets better. We could be battling this thing well into fall.

Confidence: Until we see new infections peak and patient-recoveries grow, I don’t expect much in the way of confidence. I expect asset sales to stall as people prefer to hold hard cash over anything else.

What does that mean for the mortgage business? I expect more defaults, more loan sales, and probably lower prices. Though its early days, I am seeing slight discounts for quick-close deals. I expect those discounts to grow in the coming days….but time will tell.

Does it mean we will be reducing our investor payouts? No, we have no plan to make any changes at this time…but who knows what the future holds. A couple of months ago, people were asking me if we would be increasing our payouts! The answer was “no” then too.

We will stick with 8% paid monthly and best-efforts liquidity. So far, we have had just 1 redemption and 1 investor switch from reinvesting his monthly payment to taking it in cash.

Let’s hope those affected make a speedy recovery and we see a federal program to support those who get behind on their mortgage payments so we don’t see a 2008-style mortgage crisis all over again.